HRMS SOFTWARE

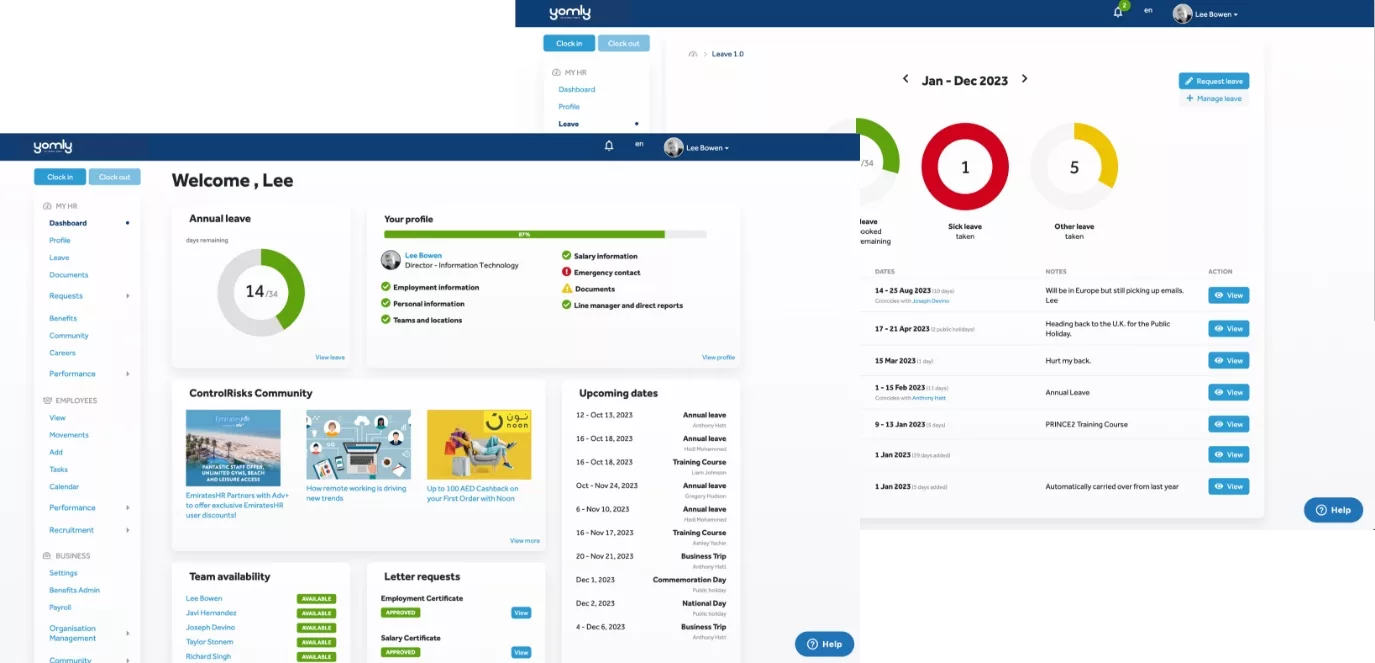

Level up your HR processes with Yomly

CORE HR with Yomly includes:

Cover all of your HR needs with our CoreHR Module.

Let Yomly take the strain of HR administration, so you can focus on your people.

Leave Management

Level up Leave Management with Yomly. Consolidate & automate time-off requests. Quickly review and approve real-time leave requests, allocate accruals, carry-overs, and banked time integrating seamlessly with your companies’ leave policies directly from the desktop or on the go in the app.

Employee Community

& Engagement

Harness the power of connectivity with Yomly’s Community page. Boost engagement and connect your employees no matter where they are located. Use Yomly’s Community Portal to post company updates, articles, employee news and benefits, FAQs and so much more. Build a strong and connected team, with Yomly’s intuitive and powerful software.

Onboarding and Offboarding

The first few days at work can be intimidating when you don’t know your way around. Eliminate time-consuming first-day formalities and walk employees through a self-service onboarding experience with Yomly.

Onboarding/offboarding employees has never been easier, the whole process is reduced to a matter of minutes. Drive engagement, with a great onboarding experience for new hires. Yomly eliminates time consuming first-day formalities and walks employees through a self-service on-boarding experience.

Document Management

Keep important documents in one place with Yomly’s centralised repository for all of your

HR documents. From employee contracts to visa information and company handbooks – documents are organised and secured in Yomly’s cloud-based platform.

View a real-time dashboard, showing your employee’s expiring documents. Push notifications will alert the employee and manager with expiry/renewal documents trigger points such as: 3 months, 1 month, & when expired. An employee’s dependents’ documents can also be uploaded and monitored in the same way.

More Features:

Organisational Charts

HR Admin

Employee Benefits

Mobile Application

Organisational Charts

Give your employees everything they need to access their benefits offering. From gratuity calculators to exclusive discounts, Yomly makes your benefits count.

HR Admin

Efficiently manage your HR and administrative tasks with an easy-to-use, flexible & customizable software.

Employee Benefits

Give your employees access to their benefits. Exclusive discounts, medical insurance details and more.

Mobile Application

Provide your employees with a self-service mobile application to edit their profile, request leave, view payslips etc.

Embedded within our holistic human capital management solutions is the Core Human Resources module. Powered by advanced HRMS software, the module is the cornerstone that seamlessly integrates with essential HR functions. This versatile module caters to crucial HR requirements, including robust employee database management, efficient onboarding and offboarding processes, comprehensive leave and absence management and streamlined document handling.

As a pivotal component of your HR infrastructure, Core Human Resources connects flawlessly with our performance management and ATS/recruitment software, boosting overall HR effectiveness.

Within this module, employee information is managed with utmost efficiency, ensuring data accuracy and ease of access. The intuitive document management system reduces the need for physical paperwork, easing document and letter handling for both employees and administrators.